A 2022 study observing the role of precious metals in portfolio diversification during the Covid-19 pandemic concluded that “gold, silver, platinum, and palladium, all serve as safe-haven assets during periods of market distress across short, medium, and long investment horizons.[1]

3 benefits make gold, and precious metals in general, a good investment choice during economic uncertainty:

#1 Portfolio diversification

#2 Hedge against inflation

#3 Fast recovery of losses

WELCOME TO GODBEX – the world’s first true investment gold exchange. Ask. Bid. Grow your wealth.

#1 PORTFOLIO DIVERSIFICATION

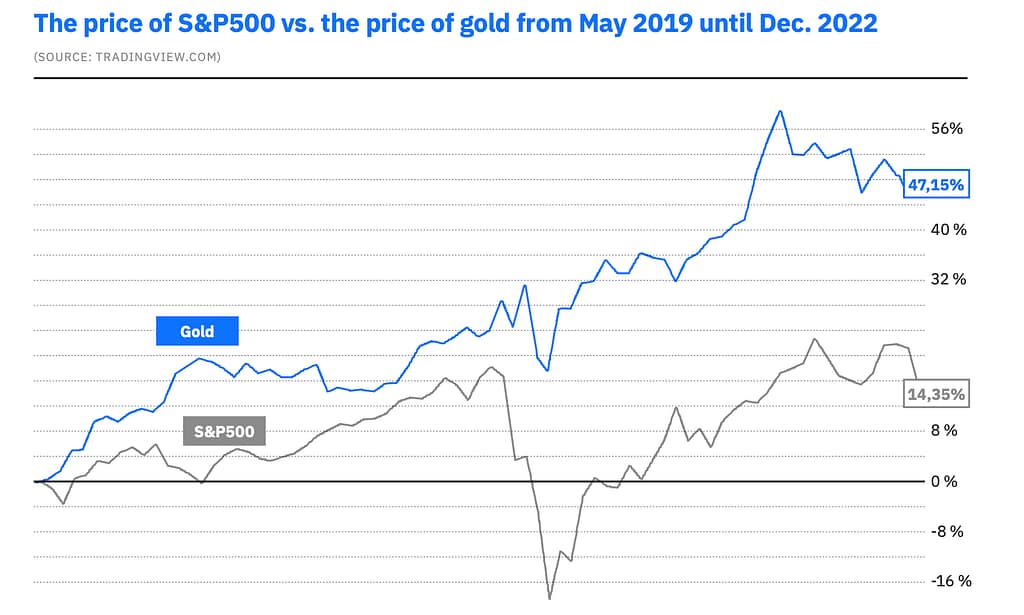

One of the key reasons to invest in gold is to protect an investor’s portfolio against rapid price movements. It’s nice to be riding a wave of rising stock or crypto prices, but when conditions worsen and those prices start plummeting, a prudent investor will be glad they’ve allocated a portion of their portfolio to gold.

In 2017, legendary investor Ray Dalio, founder of Bridgewater Associates, which is the world’s largest hedge fund, put it plainly: most portfolios should have 5 to 10 percent of its holdings allocated in gold.

An important factor when diversifying one’s portfolio is considering how a certain asset behaves compared to other assets. If an asset moves in unison with stocks, it will not be a very good portfolio diversifier. Instead, investors should consider assets that behave differently from stocks and other common investment vehicles. A recent research note by Goldman Sachs noted that gold is expected to outperform bitcoin, which is described as “highly volatile,” in the long term[2]. According to Goldman, bitcoin is similar to owning a “risk-on high-growth tech company stock,” while gold benefits from “real demand drivers” and is thus less likely to be influenced by tighter financial conditions.

#2 HEDGE AGAINST INFLATION

In 2021 and 2022, inflation reared its ugly head after being relatively tame for decades. With inflation rates in 2022 reaching 7%, 8%, or even more than 10% in some countries, the purchasing power of money rapidly and very palpably diminished. Buying groceries, paying for electricity, purchasing a car or a house – all of these cost a lot more money than they did just two years ago.

If we look at the price of gold since January 2020, which roughly coincides with the start of the global inflation rise, it increased from approximately $1,550 to $1,800. And yes, this was a volatile period even for gold, as the market conditions were unprecedented in many ways. But even during this extraordinary period, gold was one of the most stable assets you could own.

Another thing to consider: Coming into 2023, few are asking whether there will be a global recession anymore; the question instead is how deep the recession will be. A recent analysis by JP Morgan sees developed economies falling into a “mild recession” in 2023[3]. Similarly, an analysis by HSBC claims the Eurozone and the UK are already in a recession, with the U.S. likely seeing “one or two negative quarters” of growth next year[4].

During recessions, stocks typically perform poorly, unemployment rates, and wages go down[5]. And during six out of the last seven major recessions, from 1973 onwards, the price of gold increased (the sole exception being the short recession in 1980, when the price of gold rose tremendously leading up to the recession, and then losing some steam during the actual recession).

GET GODBEX APP FROM THE APP STORE AND GOOGLE PLAY: Trade precious metals with the lowest fees.

It is equally important to note that gold has outperformed the U.S. stock market in every recession since 1973. During the major financial crisis of 2008 and the global recession that followed, the S&P500 fell 46.1 percent from October 2007 to March 2009, while the price of gold increased by 16.9 percent during the same period. However, this is not the complete picture, as the price of gold actually began to rise at the start of the previous recession in March 2001, marking the beginning of one of the most prosperous periods for gold owners. At that time, the price of an ounce of gold was $263, and a little over ten years later, in August 2011, gold hit the price of $1,825 per ounce, representing a 594 percent increase.

#3 FAST RECOVERY OF LOSSES

You’ve heard about stock prices plummeting, plunging, or diving. Such adjectives aren’t often used in connection with gold, simply because it rarely happens. Due to its predictable supply and demand that’s been present for thousands of years, gold always has buyers. Gold is where prudent investors, be it large capital funds or individuals, go when they need safety.

During extreme sell-offs in times of market panic, the price of gold may go down alongside other riskier assets. However, when the first wave of panic subsides, riskier assets may continue falling, while gold recovers. In February and March 2020, global markets rapidly crashed due to mounting worries related to the Covid-19 pandemic. The price of gold fell too, albeit far less severely than those of major stock indices, but it bounced back significantly faster, recovering all losses in about a month.

A Dublin City University study looking at gold as a safe haven concluded that “gold was a strong safe haven for most developed markets during the peak of the recent financial crisis,” and that it “may act as a stabilizing force for the financial system by reducing losses in the face of extreme negative market shocks[6].”

Download GODBEX Investment Guide 2023: the In-depth Gold Analysis

What moves the price of gold? Why gold serves as a portfolio diversifier, an inflation hedge and a safe-haven asset? What is GODBEX and why is it safe to invest on the platform? Find all the relevant and useful information in free-to-download guide, including a glossary of gold-related and investment terms that every investor needs.

[6] Is gold a safe haven? International evidence, Dirk G. Baur, Thomas K. McDermott, 2009

[5] Investment Outlook 2023, J.P. Morgan Asset Management, Nov. 2022

[4] Investment Outlook Q1 2023, HSBC Global Private Banking, Nov. 2022

[3] A recession would be worse than today’s inflation, Economic Policy Institute, 2022. (https://www.epi.org/blog/a-recession-would-be-worse-than-todays-inflation/)

[2] Gold is better portfolio diversifier than bitcoin – Goldman Sachs, Reuters, Dec. 2022

(https://www.reuters.com/business/finance/gold-is-better-portfolio-diversifier-than-bitcoin-goldman-sachs-2022-12-12/)

[1] The role of precious metals in portfolio diversification during the Covid19 pandemic: A wavelet-based quantile approach, Huthaifa Alqaralleh and Alessandra Canepa, 2022.