Gold had a great run through March as the collapse of several U.S. banks boosted its demand. While regulatory intervention lowered fears of a bigger banking collapse, markets still remained wary.

Over the last week gold has rallied and sank on how investors view the FED inflation fight. Strong momentum now suffers a resistance, as the dollar’s bounce back on Friday pulled the spot price of the yellow metal down from the week’s high of $2,048 to a $1,992 low, constituting a $56 drop – but still keeping the high-level price. It happened after FED Governor Christopher Waller called for more monetary tightening even as recent data showed that U.S. inflation is steadily coming off the highs of recent months.

WELCOME TO GODBEX – the world’s first true investment gold exchange. Ask. Bid. Grow your wealth.

Although gold prices were pressured by some strength in the dollar this week, lower than expected manufacturing and employment numbers were also fueling fears of a potential recession this year. This benefited bullion prices, helping them stay around the key $2,000 level, meaning that the prospect of higher interest rates bodes poorly for non-yielding assets such as gold, but concerns over the ensuing economic slowdown kept the yellow metal relatively well-bid.

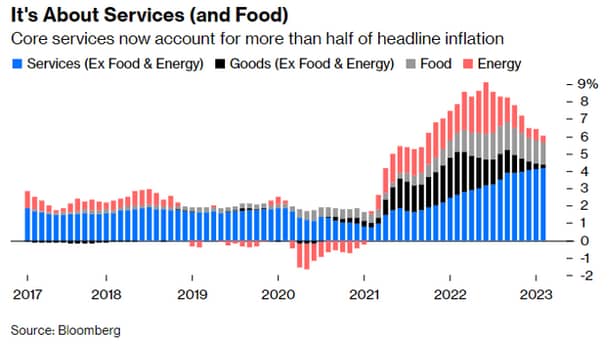

Price inflation continued to cool with March annual CPI coming in at 5%. But, whatever inflation measure we look at, we can see that inflation is not really tamed. Stripping out more volatile food and energy prices, core CPI was up 0.4%. Over the last 12 months, core CPI has been up 5.6%.

One of the inflation measures that is most closely followed is the core inflation of services observed without housing costs (the measurement of inflation in the housing segment has certain methodological limitations). Inflation also increased by 0.5% (annualized 6%, which is unacceptably high) in a monthly comparison in February.

GET GODBEX APP FROM APP STORE OR GOOGLE PLAY: Trade precious metals with the lowest fees.

So, signs of inflationary pressure still remain. While FED rushed in with a bailout scheme that includes a program allowing banks to borrow money using bonds that have been significantly devalued by rate hikes as collateral based on their face value they added $324 billion to its balance sheet. In other words, the central bank went back to creating inflation after the failure of Silicon Valley Bank and Signature Bank. The market also does not trust the FED at this point. After the outbreak of the bank crisis, the market immediately began to incorporate expectations of a soon interest rates cuts.

The first possible catalyst for another change in optimism, the one on stock markets, could be the upcoming quarterly financial reporting season. U.S. stocks were falling on Thursday after disappointing earnings reports from Tesla and AT&T. Shares of streaming giant Netflix (NASDAQ:NFLX) fell 3.9% after it issued a disappointing forecast for second quarter results. European stock markets edged lower Friday, with economic data pointing to a regional economic slowdown.

Data on Thursday also showed more Americans filing claims for unemployment benefits. Separate data showed factory activity in the mid-Atlantic region plunging to a nearly three-year low in April. British retail sales fell 0.9% on the month in March, an annual drop of 3.1%, as consumers struggled with discretionary spending given the sparing inflation.

Download GODBEX Investment Guide 2023: the In-depth Gold Analysis

What moves the price of gold? Why gold serves as a portfolio diversifier, an inflation hedge and a safe-haven asset? What is GODBEX and why is it safe to invest on the platform? Find all the relevant and useful information in free-to-download guide, including a glossary of gold-related and investment terms that every investor needs.