Increasing number of investors have embraced alternatives to trading stock and bond investments in pursuit of diversification and higher risk-adjusted returns. Consequentially, there has a been an increase in number of gold investors, with 2022 being the strongest year for gold demand in over a decade[1]. The 4 principal factors behind this growth:

1. Emerging market growth: economic expansion – particularly in China and India – increased and diversified gold’s consumer and investor base

2. Market risk: the current concerns about the economic and political outlook have encouraged investors to re-examine gold as a traditional hedge in times of turmoil

3. Monetary policy: persistently low interest rates reduce the opportunity cost of holding gold and highlight its attributes as a source of genuine, long-term returns, particularly when compared to historically high levels of global negative-yielding debt

4. Central bank demand: a surge of interest in gold among central banks across the world, commonly used in foreign reserves for safety and diversification, has encouraged other investors to consider gold’s positive investment attributes

Another recent study (2021)[2] by researchers of School of Management Studies, India, shows that the risk and return expectations of investors have changed, leading them to reallocate their portfolios. The study examined the perceptions of investors about various investment avenues before and during the period of extreme uncertainty caused by the COVID-19 pandemic. Before the 2020, stock were the highly preferred investment avenue. During the pandemic, the preferences for investment have been changed, with risk-free assets becoming more desirable: the most preferred investment avenue turned out to be insurance, followed by gold, bank deposits, and public provident funds (PPF).

GOLD AND STOCKS

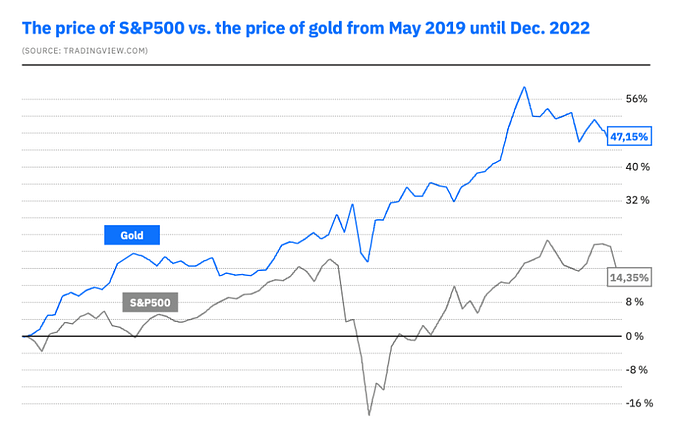

Gold has outperformed the U.S. stock market in every recession since 1973. During the major financial crisis of 2008 and the global recession that followed, the S&P500 fell 46.1% from October 2007 to March 2009. In that same period, the price of gold went up 16.9%.

When it comes to gold versus stocks, once again, it’s not an exclusive choice of one or the other. In fact, a sensible investor will likely have both in their portfolio as a means of diversification. As shown in the graph above, the price of gold will often move in the opposite way from major stock indices, thus protecting the overall value of an investor’s portfolio.

A special case in the comparison is gold-related stocks, such as shares of gold mining companies. While the price of these can be somewhat related to the price of gold, they are not the same as owning gold as they are subjected to numerous additional risks. It’s entirely possible, for example, that a gold mining company suffers a bad year, and its shares plummet while gold remains stable or even rises in price.

WELCOME TO GODBEX – the world’s first true investment gold exchange. Ask. Bid. Grow your wealth.

GODBEX: THE SIMPLEST AND MOST COST-EFFECTIVE WAY TO BUY INVESTMENT GOLD

GODBEX is the world’s first true investment gold exchange, where users set the spot price on their own terms. The price of gold is not arbitrarily fixed to any number. Instead, the market, which consists of GODBEX users, determine the price based on supply and demand. The trading of precious metals on the platform is safe, transparent, easy and has the lowest fees in the industry.

1.Why is GODBEX simple?

GODBEX represents the simplest way to trade and store physical precious metals, requiring no prior knowledge or experience. After registering, you choose the amount of investment gold you want to buy and place a bid. Once a seller is willing to sell the required gold at that price, your bid gets filled and you now own some gold.

Becoming a GODBEX user is intuitive and free-of-charge:

• Step 1 Register. Create your account and verify your identity.

• Step 2: Deposit. Deposit bullion bars you already own or fiat currency to start buying, selling or trading.

• Step 3: Trade. Set trading terms and start to trade.

• Step 4: Analyse. The dashboard gives you a complete overview of all your active orders, transactions and fees. If you prefer to have your trading information elsewhere, choose the option to export all the data.

• Step 5: Withdraw in one click? Vaulting or delivery – you choose what you want to do with your own, 100% allocated bullion bars. GODBEX gives you all the options.

2.Why is GODBEX the most cost-effective?

Registering on GODBEX is completely free of charge. However, there is a trading fee that is charged when an order is executed. Additionally, there are fees for insured and secured vaulting as well as fully insured international delivery of precious metals. The trading fee for silver is 1% for every transaction, for platinum it is 0.45%, and for palladium it is 0.20%. For investment gold, the trading fee is only 0.25%, making GODBEX the most cost-effective option in the industry for purchasing physical gold.

GODBEX INVESTMENT GUIDE 2023

To get an in-depth insights on precious metals, and a historical perspective on the price of gold, download the GODBEX Investment Guide. It is the only guide you will truly need in 2023.

[1] https://www.gold.org/goldhub/research/gold-demand-trends/gold-demand-trends-full-year-2022

[2] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7995012/