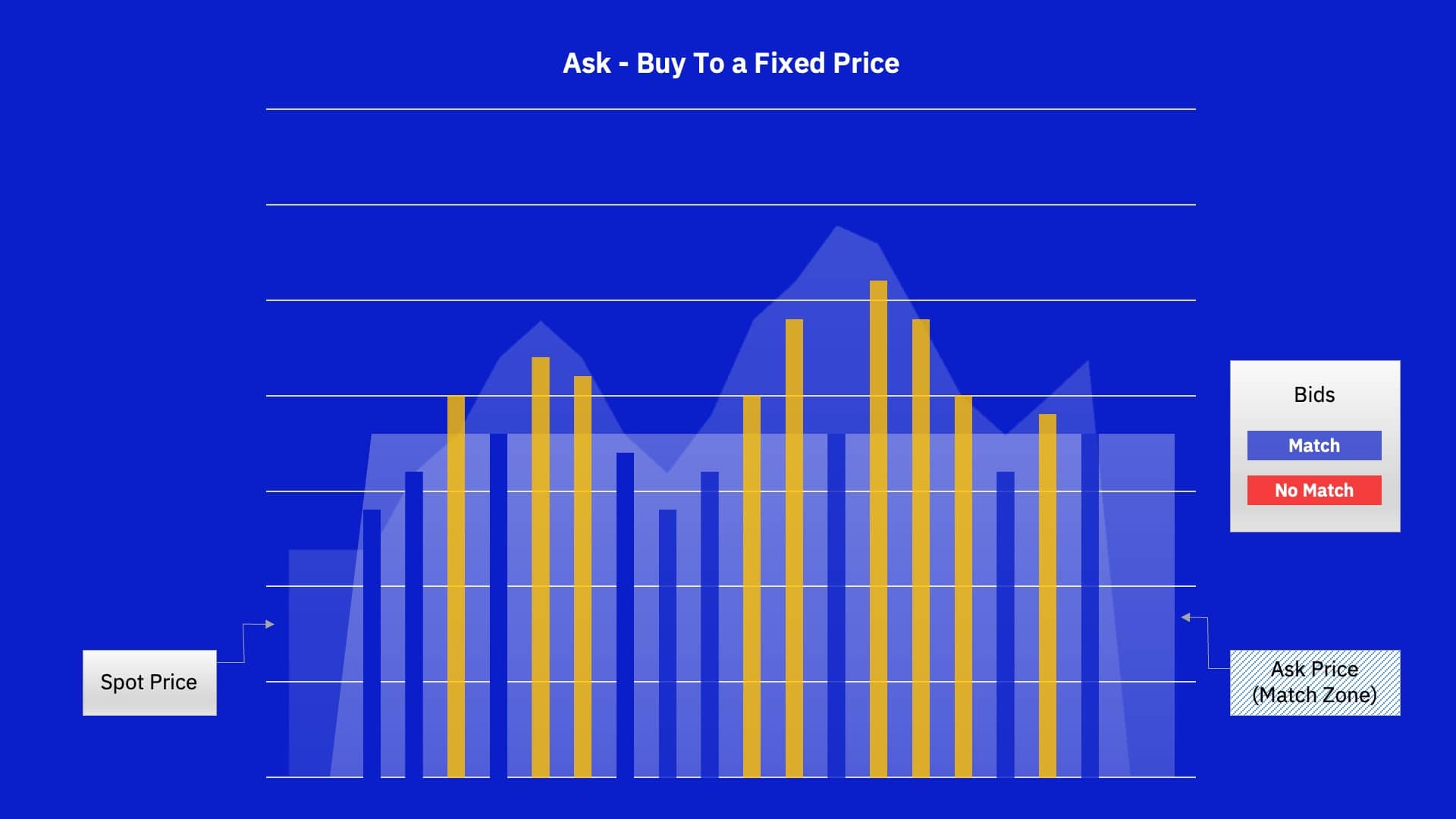

Trading options – ASK

Trading options – BID

Trading options – Auto Order

No difference – general information

To be able to activate Auto Order you should first activate one bid and one ask order – don’t forget to mark the option For template only. Auto order will be active once you click Activate Trade. Until there are existing matching orders from another user, your bid and ask orders will be automatically executed basing on the selected options for ask and bid, including minimum or maximum price, limit price and stop price. Please note that the first executed order is always your ask order.

Difference in EUR

Until there are existing matching orders from another user, your bid and ask orders will be automatically executed. Please note that the first executed order is always your ask order. Your first ask order will be executed basing on the selected options for ask, including minimum or maximum price, limit price and stop price. Each subsequent order will be executed basing on the last trade, taking into account the selected difference in EUR:

-

- limits will be set to the last executed price +/- difference in EUR,

-

- minimum or maximum fixed price will be set to the last executed price +/- difference in EUR,

-

- minimum or maximum variable price will remain as it was initially set in ask and bid options for template,

-

- stop price will remain as it was initially set in ask and bid options for template.

Difference in %

Until there are existing matching orders from another user, your bid and ask orders will be automatically executed. Please note that the first executed order is always your ask order. Your first ask order will be executed basing on the selected options for ask, including minimum or maximum price, limit price and stop price. Each subsequent order will be executed basing on the last trade, taking into account the selected difference in percentage of spot price:

-

- limits will be set to the last executed price +/- difference in percentage of spot price,

-

- minimum or maximum fixed price will be set to the last executed price +/- difference in percentage of spot price,

-

- minimum or maximum variable price will remain as it was initially set in ask and bid options for template,

-

- stop price will remain as it was initially set in ask and bid options for template.