Nearly two months after Silicon Valley Bank’s collapse another US bank falls.

The three banks that collapsed had bought long-term bonds that paid low rates and then rapidly lost value as the FED sent rates higher. As the FED continuously increased interest rates over the past year, many of First Republic’s assets lost value because they were fixed at lower interest rates and, therefore, lower payouts to the bank. Meanwhile, First Republic had to pay higher interest rates on its customers’ deposits and this combination of higher costs and lower revenue toppled the bank’s balance sheet. Previous failure of Silicon Valley Bank already made US citizens more concerned about the safety of their deposits and when First Republic’s investment strategy began backfiring, depositors started to pull out their money in large numbers. By last week, First Republic revealed that customers had withdrawn more than half of the bank’s deposits.

WELCOME TO GODBEX – the world’s first true investment gold exchange. Ask. Bid. Grow your wealth.

Regulators seized First Republic Bank and sold it to JPMorgan and it’s collapse has caused concerns that the U.S. is on the brink of a financial catastrophe, one that could resemble the 2007-8 crisis that led to the Great Recession.

Taking out big mortgages is getting harder, and commercial real estate industry is bracing for trouble as FED survey showed that the midsize banks that service it become more cautious and less willing to lend. FED economists have also estimated that tighter credit resulting from the bank failures will contribute to a “mild recession” later this year, thereby raising the pressure on the central bank to suspend its rate hikes.

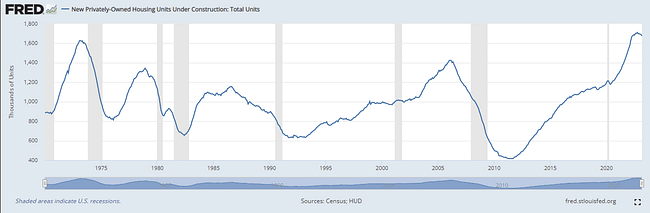

Because the housing market is so sensitive to interest rates, it tends to serve as a signal for changes in economic activity when the FED tightens or eases. The US construction sector shed a net 9,000 jobs in March, marking the first decline in 14 months according to Labor Department figures. Construction layoffs jumped to 3.7% of total employment, up from 2.3% in February, marking one of the biggest leaps on record in data beginning in 2000.

The Fed’s rate increases since March 2022 have more than doubled mortgage rates, elevated the costs of auto loans, credit card borrowing and business loans and heightened the risk of a recession resulting home sales plunge. The Fed’s latest move, which raised its benchmark rate to roughly 5.1%, could further increase borrowing costs.

GET GODBEX APP FROM APP STORE OR GOOGLE PLAY: Trade precious metals with the lowest fees.

Investors have also assessed results from banking sector and latest Federal Reserve meeting. U.S. stocks fell while government bonds and gold rallied, reflecting persistent anxieties on Wall Street about regional banks and the economic outlook. The S&P 500 slipped 0.7% while the Dow Jones Industrial Average declined 0.9% and the Nasdaq Composite lost 0.5%.

The economy appears to be cooling, with consumer spending flat in February and March, indicating that many shoppers have grown cautious in the face of higher prices and borrowing costs.

Investors are also not convinced that regional banks including PacWest and Western Alliance can remain viable. Shares of three midsize lenders fell more than 30%, while a broad index of regional banks dropped 3.5% to its lowest level since 2020. Reflecting demand for safer assets, the yield on the benchmark 10-year U.S. Treasury note also fell, while gold briefly touched $2,050 a troy ounce.

The banking crisis has increased the demand for gold as a proxy for lower real rates as well as a hedge against a ‘catastrophic scenario and gold has reached a fresh record high with the latest move being fueled by FED’s not least continued worries that more US regional banks could be in trouble with more bailouts to follow.

Download GODBEX Investment Guide 2023: the In-depth Gold Analysis

What moves the price of gold? Why gold serves as a portfolio diversifier, an inflation hedge and a safe-haven asset? What is GODBEX and why is it safe to invest on the platform? Find all the relevant and useful information in free-to-download guide, including a glossary of gold-related and investment terms that every investor needs.