In retrospect, financial crises do not generally appear to be sudden events, but researching and explaining historical events is not the same as predicting future ones.

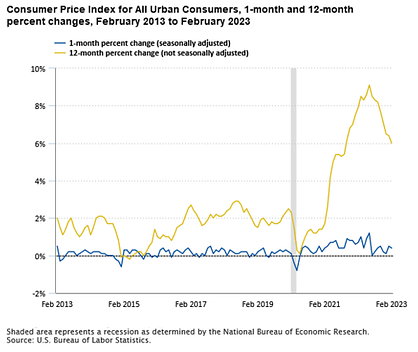

The decline of shares that has been going on in the American stock market since last year with several longer and shorter rallies seems to be entering a new phase. Although the beginning of this year brought optimism and a slightly more pronounced growth of shares carried by the optimism of a slowdown in inflation, the FED had to increase the pace of raising interest rates above initial expectations in order to keep inflation under control.

WELCOME TO GODBEX – the world’s first true investment gold exchange. Ask. Bid. Grow your wealth.

A shock within the banking sector followed very quickly. After the fall of the cryptocurrency market, and the Silvergate banks associated with them, Silicon Valley Bank and Signature bank soon collapse, and panic soon sets in on the market. But why did the problem occur? The previously mentioned FED raising interest rates caused a fall in the value of government bonds, which banks were forced to sell before maturity due to a lack of liquidity.

GET GODBEX APP FROM APP STORE OR GOOGLE PLAY: Trade precious metals with the lowest fees.

Although the American regulators very quickly decided to cover all deposits in 100% amount, this is nowhere near the end of crisis in the banking sector. Many banks own large amounts of government bonds and at the same time, if they are forced to start selling bonds due to distrust of their depositors and mass withdrawal of deposits, there could be a large loss of bank capital, and further bankruptcies.

In order to prevent depositors and keeping deposits, and in order to compete with other markets such as money funds, banks will have to start increasing interest on savings, but this move also means a drop in their profitability.

Of course, all this affects other economic sectors, such as the real estate market, which cools down due to the rise in interest rates, which also reduces the scope of the construction sector’s operations, and it was the banks mentioned earlier that were a major creditor of this sector. What will happen to the US economy and banking system in the event of another housing market crash remains to be seen. In the meantime, the FED prepared a program of short-term loans to help banks with liquidity, and the failing Credit Suisse was sold to UBS, which brought relief to the American and European markets. But many investors believe that this is a short-term respite and that more bad news is waiting around the corner, as rumors about Deutsche Bank’s problems started again last week.

In case of a more aggressive increase in interest rates, such as what FED is currently doing, some investors still turn to bonds, which in such a situation will bring good yields, but when the market does not believe in success of central bank for numerous other reasons, such as energy crisis, which central bank has no significant influence on, gold is once again becoming one of the more attractive investments for investment diversification and inflation protection.

What does this mean for gold? Historically, recessions and inflation have always meant rising gold prices as a safe haven. After the fall of the stock market in 2007, the demand for investment in gold increased, and its value doubled by 2011. Growth, although not so dramatic, also occurred during the uncertainty during the pandemic.

Gold has a key role as a strategic long term investment in a well-diversified portfolio. Recently, Swiss gold exports to China are on the rise, reaching 58 tonnes in February, a big increase from 26.1 tonnes in the previous month. In the same period, exports to India reached 25.6 tons compared to 3.2 tons in January. Turkey imported around 58 tonnes of gold from Switzerland in January which was the largest amount in any month on record going back to 2012.

Gold is a great diversifier to any portfolio because it behaves differently to equities and bonds, not because it has a low volatility. And while it is less volatile asset than some equities, in some years it had close to 30% gains (2010) while in other years it had 30% losses (2013). But on balance however, gold has an asymmetric correlation profile with equities. In other words, it does much better when equities fall than it does badly when equities rise.

Download GODBEX Investment Guide 2023: the In-depth Gold Analysis

What moves the price of gold? Why gold serves as a portfolio diversifier, an inflation hedge and a safe-haven asset? What is GODBEX and why is it safe to invest on the platform? Find all the relevant and useful information in free-to-download guide, including a glossary of gold-related and investment terms that every investor needs.